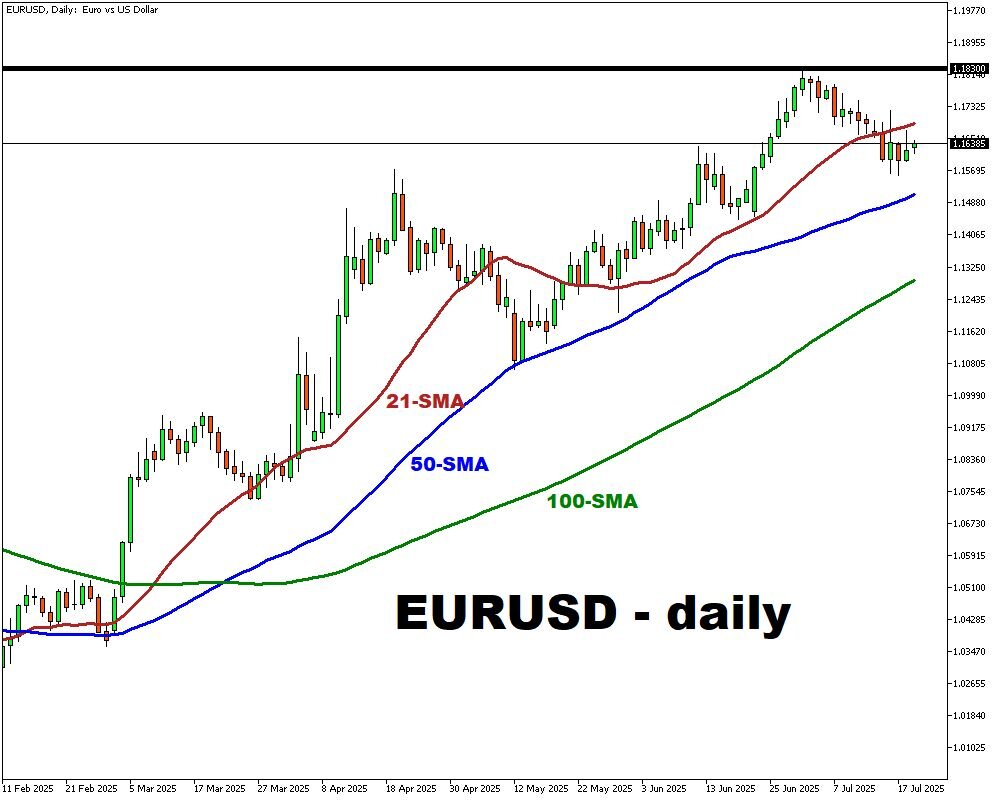

This Week: EURUSD – potential volatility ahead!

- Powell speech may sway USD rate expectations

- ECB tone to drive EUR near-term direction

- Germany Ifo key to euro confidence

- Volatility expected on data, policy shifts

Economic uncertainty, shifting fiscal landscapes, and evolving interest rate expectations are steering EURUSD, with traders remaining on edge. This week, a packed schedule of macroeconomic events could inject fresh volatility and reshape the market narrative.

EURUSD continues to trade reactively to economic signals, with important speeches, policy developments, and macro indicators shaping its path. As markets digest the data, short-term swings are likely to persist.

Events Watchlist:

Tuesday, July 22nd: Fed Chair Powell Speech

Traders will be tuned into Powell’s remarks for any shifts in the Fed’s tone. With rate expectations delicately balanced, any hint of policy flexibility or concern over inflation could influence EURUSD positioning. Markets will react swiftly to guidance on the economic outlook, especially regarding labor and inflation dynamics.

Thursday, July 24th: ECB Interest Rate Decision

The ECB's tone will be critical in shaping euro direction. A hawkish stance may support the euro, potentially lifting EURUSD toward the 1.18300 area, while dovish rhetoric could send the pair lower toward 50-day MA. Traders will be particularly focused on any remarks regarding inflation or labour market.

Friday, July 25th: Germany Ifo Business Climate (Jul)

This key sentiment gauge will offer insight into German business conditions. A stronger-than-expected reading could bolster euro confidence and support EURUSD, while a weaker outcome might raise concerns, weighing on the pair.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, July 21

- CAD: BoC Business Outlook Survey; Canada PPI (Jun), Raw Material Prices (Jun)

- NZD: New Zealand Balance of Trade (Jun)

Tuesday, July 22

- AU200: RBA Meeting Minutes

- MXN: Mexico Economic Activity (May), Retail Sales (May)

- USD: Fed Chair Jerome Powell Speech, Fed Governor Bowman Speech

- WTI: API Crude Oil Stock Change (w/e Jul 18)

Wednesday July 23

- JPY: BoJ Uchida Speech; Japan Foreign Bond & Stock Investment by Foreigners (w/e Jul 19)

- SG20: Singapore Inflation Rate (Jun)

- GBPUSD: UK 2040 Gilt Auction

- EUR: Eurozone Consumer Confidence (Jul)

- USD: US Existing Home Sales (Jun)

- WTI: EIA Crude Oil Stocks Change (w/e Jul 18)

- AUD: Australia S&P Global Manufacturing, Services and Composite PMIs (Jul)

- Earnings: Alphabet, Tesla, IBM

Thursday, July 24

- GER40: Germany GfK Consumer Confidence (Aug), HCOB Manufacturing, Services & Composite PMIs (Jul)

- EU50: HCOB Manufacturing, Services & Composite PMIs (Jul)

- UK100: UK S&P Global Manufacturing, Services & Composite (Jul), GfK Consumer Confidence (Jul)

- EUR: ECB Interest Rate Decision

- USD: Initial Jobless Claims (w/e Jul 19)

- NG: EIA Natural Gas Stocks Change (w/e Jul 18)

Friday, July 25

- SG20: Singapore Industrial Production (Jun)

- GBP: UK Retail Sales (Jun)

- FRA40: France Consumer Confidence (Jul)

- EUR: Germany Ifo Business Climate (Jul), ECB Consumer Inflation Expectations (Jun)

- USD: US Durable Goods Orders (Jun)

- Brent: Baker Hughes Oil Rig Count (w/e Jul 25)

Sunday, July 27

- CNY: China Industrial Profits (Jun)