central-bank-week-–-spotlight-on-usdind-and-major-fx-pairs

- Fed commentary could sway USDInd direction

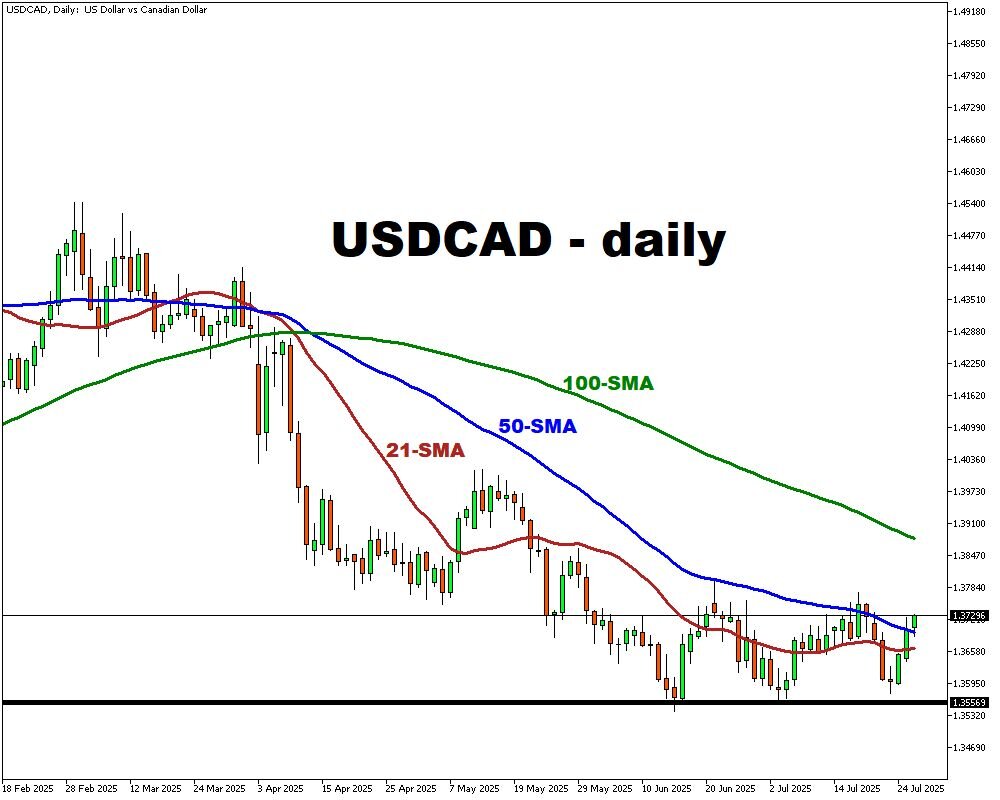

- BoC tone may drive USDCAD volatility

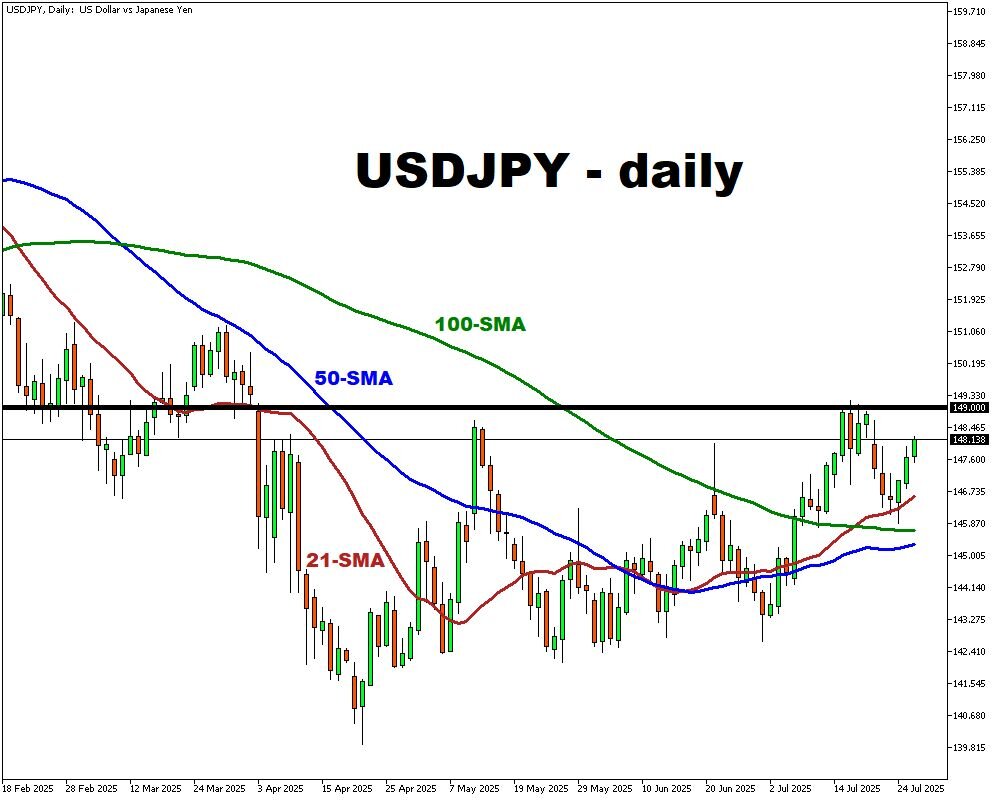

- BoJ signals may jolt USDJPY moves

- US-China tariff talk – in focus

- Big tech earnings this week

A pivotal week lies ahead for currency markets as three major central banks, the Federal Reserve, Bank of Canada, and Bank of Japan, take the spotlight. As central banks navigate inflation paths and growth concerns, key instruments like USDInd, USDCAD, and USDJPY are likely to experience elevated volatility.

Adding to the mix, market participants are also eyeing the looming Trump tariff deadline (Aug 1 – tentative), which could inject further uncertainty into global trade dynamics and market sentiment.

Events Watchlist:

Wednesday, July 30th: Fed Interest Rate Decision – USDInd

With the Fed widely expected to hold rates steady, the USDInd direction hinges on forward guidance. A hawkish tilt, highlighting persistent inflation or dismissing imminent cuts could lift USDInd back toward recent resistance at 50-day MA. On the other hand, dovish signals may trigger a pullback toward the 96.393 area.

Wednesday, July 30th: BoC Interest Rate Decision – USDCAD

The BoC decision will be key for near-term USDCAD trajectory. A dovish tone or hints of further easing could send USDCAD climbing toward the 1.3699–1.3887 zone. Alternatively, hawkish signals, could push USDCAD lower toward key support at 1.3557. Cross-sensitivity to the Fed's stance could amplify either move.

Thursday, July 31st: BoJ Interest Rate Decision – USDJPY

With BoJ expectations muted, surprises may carry outsized impact. Hints of policy normalization or upward revisions to inflation forecasts could spark yen strength, sending USDJPY lower towards 50-day MA. Conversely, a dovish tone may support a rally toward/above 148.00, especially if coupled with a hawkish Fed.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, July 28

- GBP: UK CBI Distributive Trades (Jul)

- MXN: Mexico Balance of Trade (Jun); Unemployment Rate (Jun)

- USD: Dallas Fed Manufacturing Index (Jul)

Tuesday, July 29

- SPN35: Spain GDP (Q2)

- GBP: BoE Consumer Credit (Jun); Mortgage Approvals (Jun); Mortgage Lending (Jun)

- USD: US JOLTs Job Openings (Jun); Goods Trade Balance Adv (Jun); Wholesale Inventories Adv (Jun)

- WTI: API Crude Oil Stock Change (w/e Jul 25)

- Earnings: Procter & Gamble, Spotify, Starbucks

Wednesday July 30

- NZD: New Zealand ANZ Business Confidence (Jul)

- AUD: Australia Inflation Rate (Q2)

- FRA40: France GDP (Q2)

- GER40: Germany GDP (Q2)

- EZ: Eurozone GDP (Q2); Economic Sentiment (Jul)

- USD: US GDP (Q2)

- CAD: BoC Interest Rate Decision

- US500: Fed Interest Rate Decision

- JPY: Japan Industrial Production (Jun)

- Earnings: Microsoft, Meta, Qualcomm, Arm Holdings,

Thursday, July 31

- CNY: China NBS Manufacturing PMI (Jul)

- JP225: BoJ Interest Rate Decision; Consumer Confidence (Jul)

- CHF: Swiss Retail Sales (Jun)

- EUR: France Inflation Rate (Jul)

- GER40: Germany Inflation Rate (Jul)

- USD: US PCE Price Index (Jun); Personal Income (Jun); Personal Spending (Jun)

- JPY: Japan Unemployment Rate (Jun)

- Earnings: Apple, Amazon, Strategy (MicroStrategy)

Friday, Aug 1

- CHINAH: China Caixin Manufacturing PMI (Jul)

- CHF: procure.ch Manufacturing PMI (Jul)

- EUR: Eurozone Inflation Rate (Jul)

- MXN: Mexico Business Confidence (Jul)

- USD: US Non-Farm Payrolls (Jul); Unemployment Rate (Jul); ISM Manufacturing PMI (Jul); Average Hourly Earnings (Jul)

- Trump’s Tariff Deadline – Tentative