Gold slips as U.S. jobless claims continue to decline

- Gold dips on strong U.S. jobless claims report

- Rate cut hopes fade as labor market stays firm

- FOMC meeting, NFP data eyed next week

- Dovish Fed tone could lift gold to $3,500

- Safe-haven appeal eases on trade progress

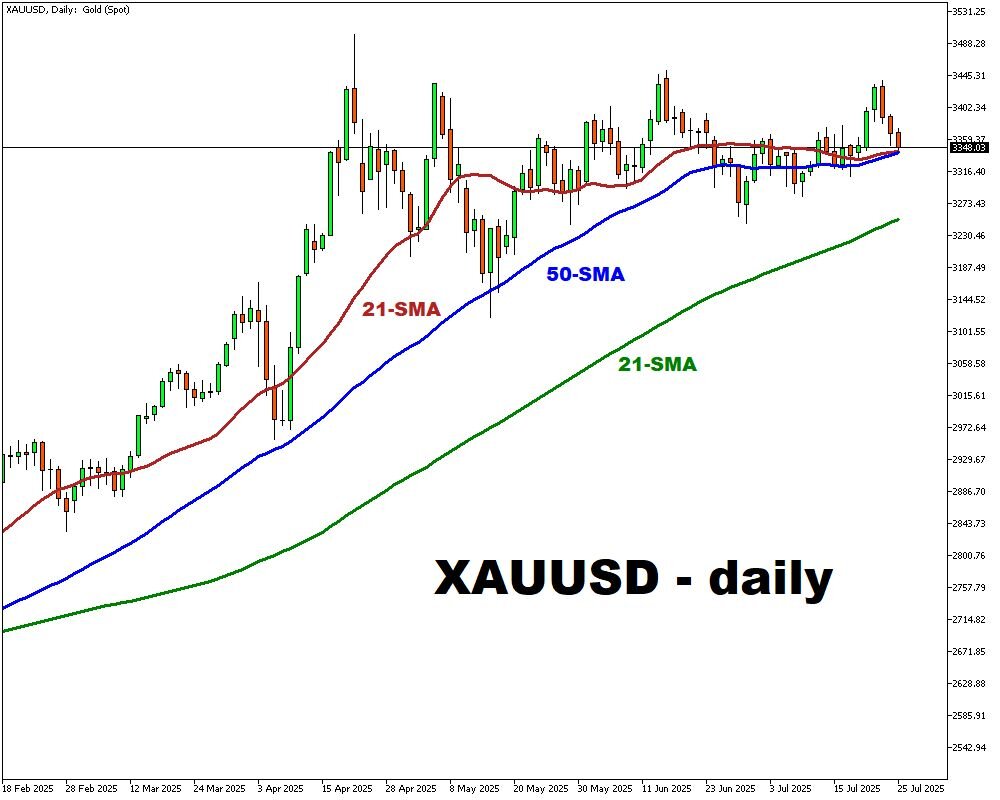

Gold is weighed down by fresh signs of U.S. labor market strength that boosted the dollar and Treasury yields. On Friday, spot gold slipped to approximately $3,350 per ounce, marking a third consecutive daily decline. The drop came as U.S. jobless claims fell for a sixth straight week, signaling continued resilience in hiring. That data tempered hopes for an imminent Federal Reserve rate cut, pressuring non-yielding assets like gold.

While bullion bulls were discouraged by the labor market’s durability, attention now turns to next week’s pivotal events: the FOMC meeting and the latest Non-Farm Payrolls (NFP) report. Traders are poised to react to any dovish shift in Fed Chair Jerome Powell’s tone.

Elsewhere, gold’s safe-haven appeal dimmed further as global trade tensions showed signs of cooling. Reports indicate the U.S. and EU are nearing a trade pact, following a separate agreement with Japan. Meanwhile, political friction between President Trump and Powell resurfaced, though Trump clarified his rate-cut calls weren’t tied to Fed renovation disputes.

Despite headwinds, spot gold is finding technical support around its 50-day moving average, holding ground ahead of a high-stakes week.