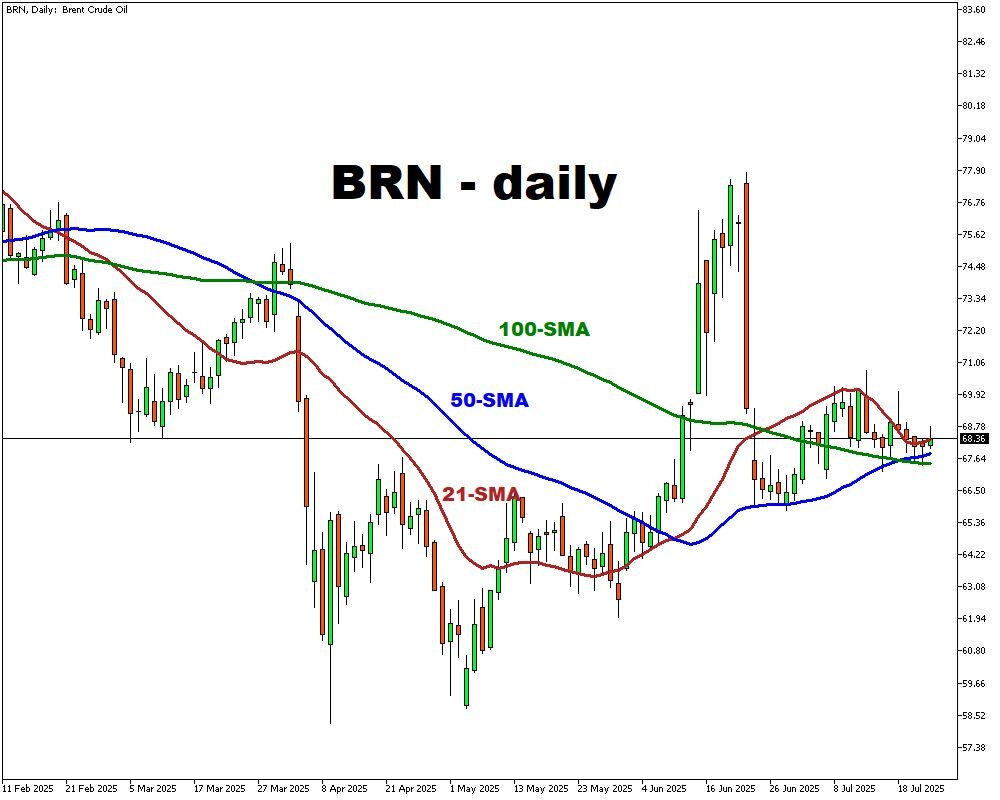

Brent tops $68 per barrel

- Brent >$68, rebound after four-day decline

- U.S. and Japan reach trade agreement

- Potential U.S.–EU trade deal in focus

- U.S. crude inventories drop by 3.2 million barrels

- Upcoming U.S.–China meeting could sway market sentiment

Brent traded above $68 per barrel on Thursday, breaking a four-session losing streak as global market sentiment improved.

Investor optimism was lifted by the announcement of a new trade agreement between the U.S. and Japan, alongside reports of ongoing negotiations between the U.S. and the European Union. Early details suggest the two sides are considering a 15% tariff on a broad range of EU imports, mirroring the recent U.S.–Japan accord.

Markets interpreted this as a step toward easing trade tensions, helping to alleviate concerns over global oil demand.

Adding further momentum, the latest data from the U.S. Energy Information Administration (EIA) showed a sharper-than-expected drawdown in crude inventories, down 3.2 million barrels last week signaling firm demand.

Traders are also closely monitoring reports on an upcoming meeting between the U.S. Treasury Secretary and Chinese officials, set for early next week. The talks are expected to cover the extension of the current trade truce and potential discussions around sanctioned oil flows.

These developments could play a key role in shaping oil price dynamics going forward.