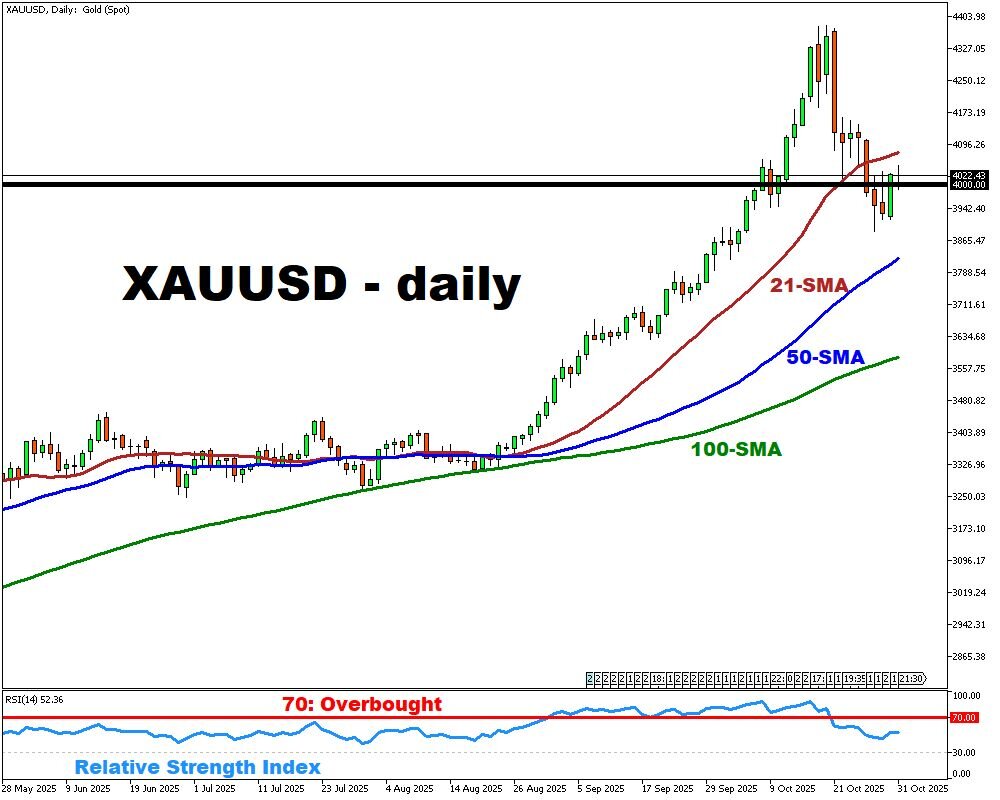

Gold’s Tug of War at $4,000 An Ounce

- Gold hovers near $4,000/oz after second weekly drop

- Fed hesitation and strong dollar weigh on bullion

- US-China minerals/trade deal adds risk-on pressure

- Meanwhile central banks snapped up ~220t in Q3

- 2025 year-to-date gain ~50%, safe-haven demand intact

Gold finds itself in a precarious position. After clawing back toward the psychologically important $4,000 per ounce mark on Friday, the metal is facing renewed pressure from two opposing forces.

On one hand, headline expectations of an imminent rate cut by the Federal Reserve have receded, Chair Jerome Powell explicitly warned that a December cut is “not assured”, which has buoyed the US dollar and made gold more expensive for foreign buyers.

The dollar’s rally and fading stimulus hopes have forced gold prices down for a second straight week. Meanwhile, a tentative trade truce between the United States and China including a one-year deal on rare earths and critical minerals, and eased import tariffs has slightly lifted risk appetite and pulled some safe-haven shine off gold.

Yet this optimism remains fragile. On the demand side, the fundamentals remain robust: the World Gold Council reports that central banks bought around 220 tons of gold in Q3, up 28% from the prior quarter.

The metal’s year-to-date gain of roughly 50% is underpinned by strong central-bank buying and investment interest.

In short: gold is caught between macro headwinds (strong dollar, reduced rate-cut hopes) and underlying structural tailwinds (official buying, safe-haven appeal, inflation risk).

While near-term action may remain choppy as the Fed and trade headlines dominate, the medium-term setup still favors gold, especially if inflation remains sticky or policy becomes more accommodative.