Gold retreats below $4000 ahead of busy week

- Gold headed for eighth weekly gain,

- Fundamentals favour bulls but technicals signalling potential correction

- US political risk, Fed Chair Powell and geopolitical developments in focus

- Bloomberg FX model – 70.2% - ($3889.38 - $4112.34)

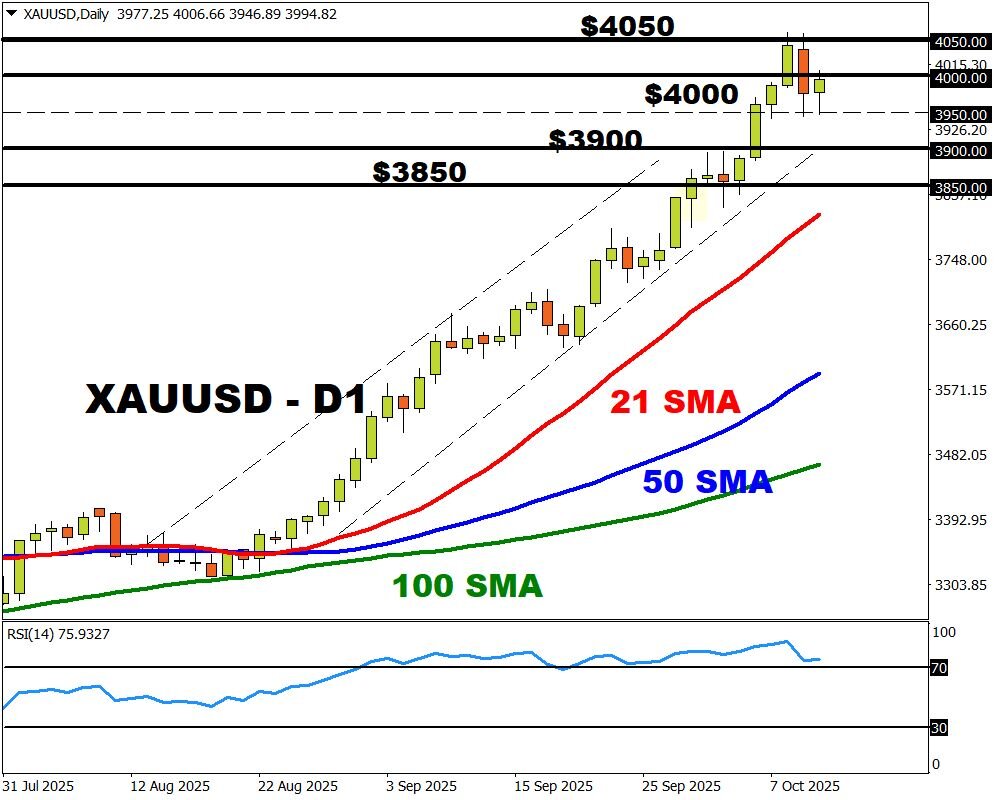

- Technical levels: $4000

Gold is attempting to nurse wounds from Thursday’s aggressive selloff, fuelled by profit-taking and an appreciating dollar.

Nevertheless, the precious metal is headed for an eighth weekly gain – powered by US political risk, bets around lower US interest rates, and central bank buying.

While the cocktail of bullish fundamental themes may keep prices buoyed, technical indicators are signalling a potential correction. This may be triggered by persistent weakness below the $3950 support.

In the week ahead, more developments around the government shutdown and a speech by Fed chair Jerome Powell may influence gold’s near-term outlook.

Looking at the charts, a break above $4000 could signal a move back toward $4050 and higher. Weakness below $3950 may open the doors toward $3900 and lower.

Bloomberg’s FX model forecasts a 70.2% chance that XAUUSD trades between $3889.38 - $4112.34 over the next one-week period - using current levels as a reference.

XAUUSD