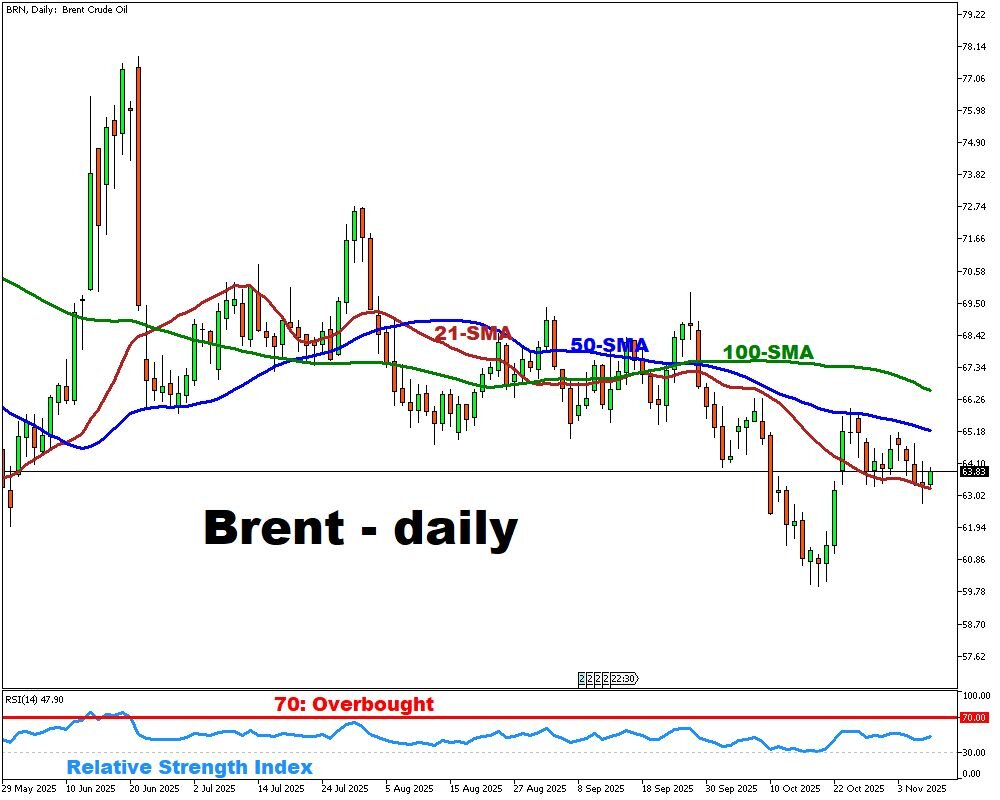

Brent steady near $64

- Brent trades near $64, set for 2nd weekly loss now

- OPEC+ hikes modestly, surplus risk into late 26 Q4

- Saudi cuts Asia prices to defend key market share

- Sanctions disrupt trade flows

Crude prices for Brent crude oil are holding near $64 per barrel on Friday, but the broader trend shows the market on course for a second straight weekly loss, reflecting growing worries about excess supply and stagnant demand.

Output from the OPEC+ alliance has edged higher as some members gradually unwind earlier curbs, while non-OPEC producers continue to add modest volumes — together fueling concern about a looming glut. The world’s largest oil exporter, Saudi Arabia, has responded to soft fundamentals by cutting its December crude prices for Asian buyers, a move widely viewed as an effort to preserve market share amid rising competition.

Meanwhile, U.S. demand remains subdued, with refinery runs and consumption both under pressure, reinforcing the sense of an oversupplied market.

On the supply-risk side, tightened sanctions and shifting trade routes continue to add nuance, keeping some upside potential alive — but for now they are insufficient to counter the prevailing surplus narrative.