Gold's bullish surge amid fed easing bets

- Gold hits $4,190/oz on Fed cut hopes

- 80% odds for Dec 25bps rate slash

- Fourth monthly gain; best year since '79

- Central banks, ETFs fuel inflows surge

- 2026 forecasts: over $4,000/oz

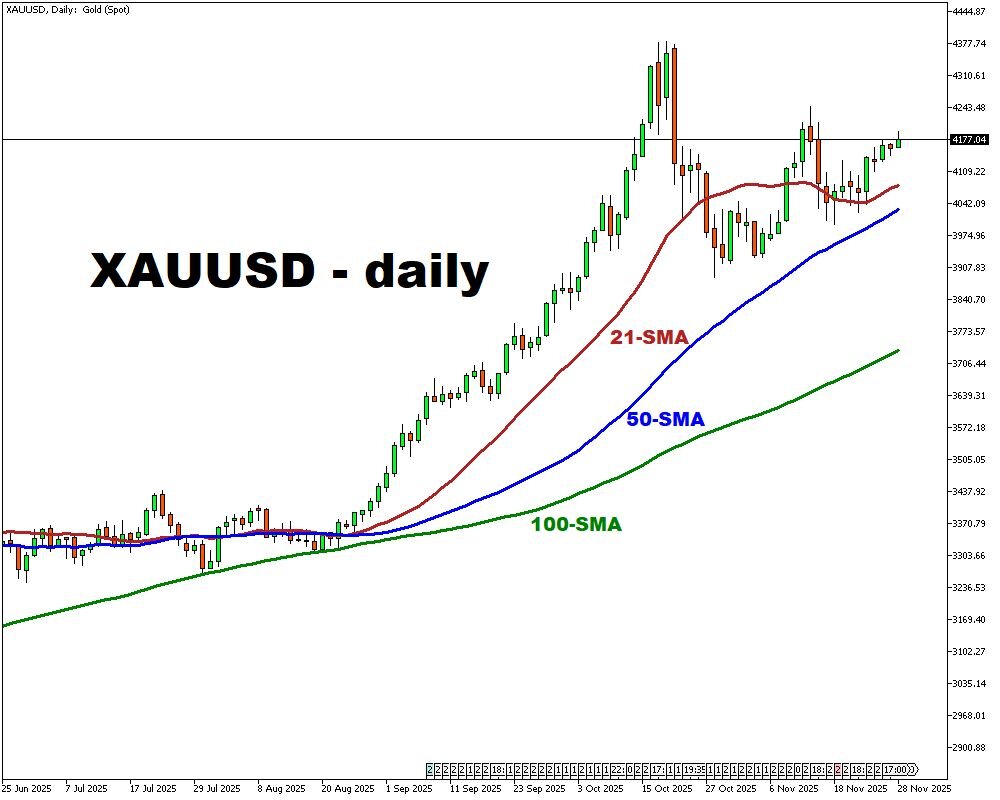

Gold prices have surged to approximately $4,190 per ounce as of late November 2025, marking a five-week high and positioning the precious metal for a fourth consecutive monthly gain.

This momentum is primarily driven by escalating investor confidence in a Fed rate cut in December, fueled by a chorus of supportive remarks from Fed officials and underwhelming U.S. economic indicators, including softer retail sales data.

Markets now embed over an 80% probability of a 25-basis point reduction next month, a stark rise from just 30% a week prior, while anticipating three additional cuts by the end of 2026.

Compounding this, potential shifts in Fed leadership, with Kevin Hassett emerging as a frontrunner to succeed Jerome Powell and aligning with President Trump's advocacy for monetary easing, further bolsters the dovish outlook.

The rally underscores gold's enduring appeal as a safe-haven asset amid geopolitical uncertainties and persistent inflation concerns, though the latter has eased somewhat.

Central banks' voracious buying, alongside robust inflows into gold-backed ETFs has provided a sturdy foundation, propelling the metal toward its strongest annual performance since 1979.

Forecasts eyeing prices above $4,000 per ounce well into 2026, supported by a weakening dollar and global liquidity injections.

However, risks linger: a surprise hawkish pivot from the Fed or robust employment data could temper gains, introducing volatility. Nonetheless, the current trajectory signals gold's resilience in a low-rate environment, offering portfolio diversification as equities face headwinds from potential policy recalibrations.